Explore with Saros #2: Everything you need to know about Hedge Protocol (HDG)

Welcome back to Explorer-with-Saros! In this episode, we will take a closer look into another great lending protocol - Hedge - to see what they bring to the table as well as how we can maximize profits with Hedge's tokens on Saros.

What is Hedge?

Hedge is a lending protocol built on Solana. With Hedge, users can access 0% interest loans by depositing collateral for stablecoin USH. The maximum loan-to-value that Hedge offers are up to 90.9%, which means that borrowers only need to deposit 9.1% collateral to receive the loan.

Users are encouraged to maintain a collateral-to-debt ratio greater than 110% to prevent liquidation. When an undercollateralized vault is liquidated, users who deposited USH in a stability pool are rewarded with discounted collateral.

Hedge Protocol has been audited by Kudelski, OtterSec, and Sec3 (formerly Soteria).

How does Hedge work?

Hedge enables users to mint USH, a stablecoin soft-pegged to the USD, on flexible terms. USH ceiling price is $1.10 and is always redeemable. If USH is traded above $1.10, users can make a profit by selling USH on the market.

To start using Hedge, users can deposit their collaterals in a Hedge vault and pay a one-time fee of 0.5% of the loan amount to take a loan. Hedge provides vaults with a collateral ratio as low as 110%, allowing for up to 11x leverage. Currently, Hedge accepts SOL, mSOL, and cUSDC as collaterals. The loan users receive is issued in USH.

Once borrowed, users do not have a deadline of when they need to repay their loan as long as they maintain a positive collateral ratio for their vault. They can use USH to exchange for other stablecoins, buy more SOL with USH and add these tokens to the collateral vault to leverage their SOL exposure, or deposit USH in the stability pool and be rewarded in SOL and HDG tokens.

As an example, users create a Hedge vault with 1,000 SOL (worth $35,000 if the SOL price is $35). They take out a loan of 5000 USH, which is pegged to USD, and make a purchase of $5000 as they wish.

In a scenario where SOL price goes up to $100 a year later, their collateral is then worth $100,000 while, their debt is still $5,000, and their vault is now $95,000. They made a profit of $65,000 and can withdraw it or keep it in the vault until they want to close it.

However, if the price of SOL goes down, they might have to face liquidation. For instance, if the vault was opened when SOL was at $150/SOL and the collateral (SOL) price has fallen to $136.25. This will make the vault fall below the 110% min collateral ratio. The vault is now subject to liquidation as below.

Hedge Token Use Cases

The Hedge Protocol issues 2 protocol tokens: HDG and USH.

- HDG: It is a revenue share and governance token. It’s used to reward market makers for providing liquidity to the system by capturing a proportional share of the protocol revenues when staked.

- USH: It is a USD-pegged stablecoin. Each $1 equivalent of USH is backed by at least $1.10 equivalent of collateral.

At launch, users may stake HDG to earn a portion of protocol fees, which are taken during the loan initiation. This model may change as the protocol matures and HDG is used for governance.

Team

Hedge Protocol is led by:

- Co-Founder - Sebastian Grubb: Former Product Manager at Google.

- Co-Founder and CTO - Chris Coudron: Co-Founded ChoicePass, a startup that was acquired by Salesforce and then folded into Work.com.

Investors

Recently, Hedge Protocol has announced $3.7 million in a seed funding round with the participation of many famous investment funds such as:

- Race Capital: Lead the investment round. The firm invests, builds, and partners with the projects at a very early stage.

- Pantera Capital: An investment firm that focuses exclusively on ventures, tokens, and projects related to blockchain tech, and digital currency.

Along with many other investment funds such as Solana Ventures, Big Brain Holdings, Shima Capital, and DCM.

This fund will be used to expand the company and make its liquidity vaults available to the general public this quarter.

Hedge Token Key Metrics

- Token Name: Hedge

- Ticker: HDG

- Blockchain: Solana

- Token Standard: SPL

- Contract: 5PmpMzWjraf3kSsGEKtqdUsCoLhptg4yriZ17LKKdBBy

- Token type: Utility, Governance.

- Total Supply: 10,000,000 HDG

Hedge Token Allocation

- Team & Advisors: 25%

- Liquidity Incentives: 25%

- Stability Pool: 20%

- Treasury: 10%

- Seed Investors: 10%

- Community Rewards: 5%

- Future Fundraising: 5%

Hedge Token Sale

Hedge Protocol intends to go public in the second quarter of 2022 after the TVL of DeFi on Solana surpasses $6.7B.

Hedge Token Release Schedule

How to get Hedge Token in the Protocol

- HDG Token: Users can get HDG by depositing USH in the stability pool and get rewarded with HDG, or stake HDG on the Hedge platform to collect a percentage of the platform fees.

- USH Token: Users can get USH by depositing collaterals in a Hedge vault to take a loan in USH.

How to maximize returns with HDG/USH token on Saros

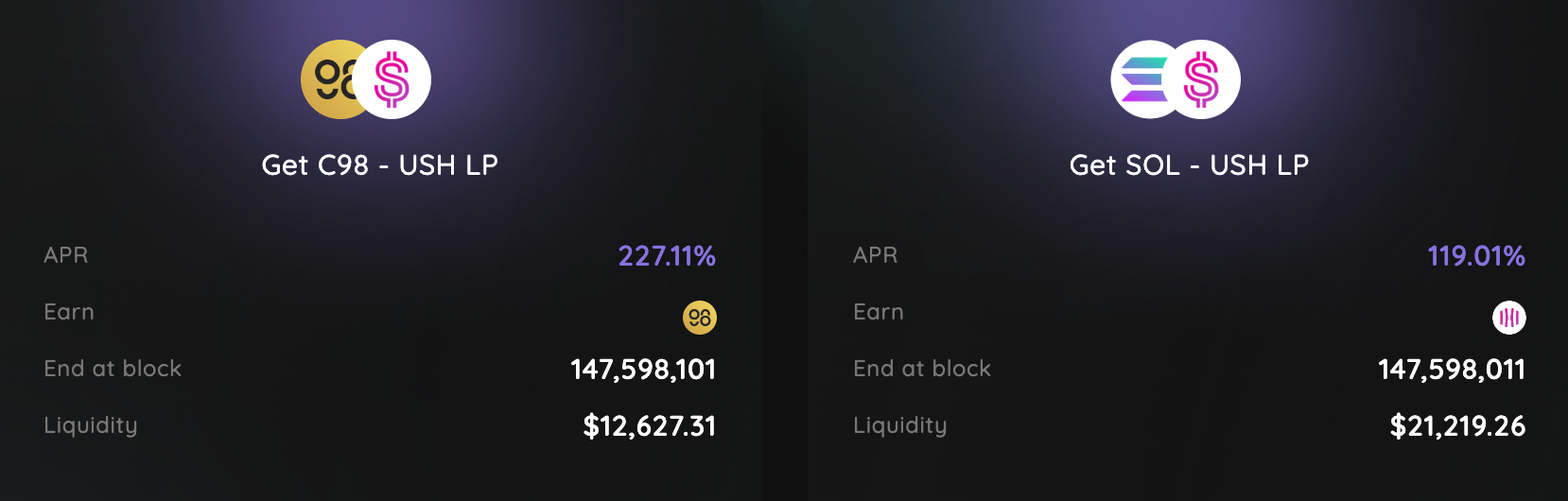

- SarosFarm: Add C98-USH and/or SOL-USH LP and start earning juicy rewards.

- SarosStake: Not fond of impermanent loss? Stake HDG - earn HDG pool is your friend!

Conclusion

We hope that after this post, you have gained a better understanding of Hedge Protocol as well as how to make the most out of HDG/USH tokens on Saros.

See you all in the upcoming posts of Explore-with-Saros Series!

Disclaimer: The information provided is given only for educational purposes, and it should not be considered financial advice. Saros is not liable for any financial losses or other damages incurred as a result of utilizing the aforementioned initiatives, platforms, or cryptocurrencies.

About Saros Finance

Saros Finance is the ultimate DeFi platform native to Solana, with trading, staking, and yield farming services. Built by Coin98 Labs, Saros Finance aims to adopt millions of users to DeFi.